Your journey to financial wellness begins here

You don’t have to be rich to live the life you’ve always wanted for you and your family.

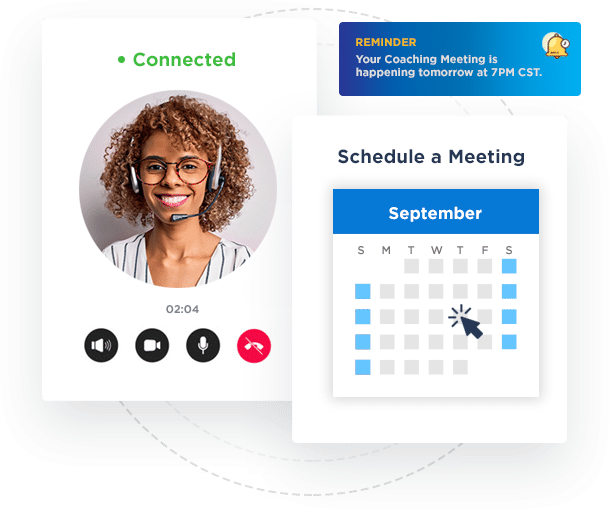

How it Works

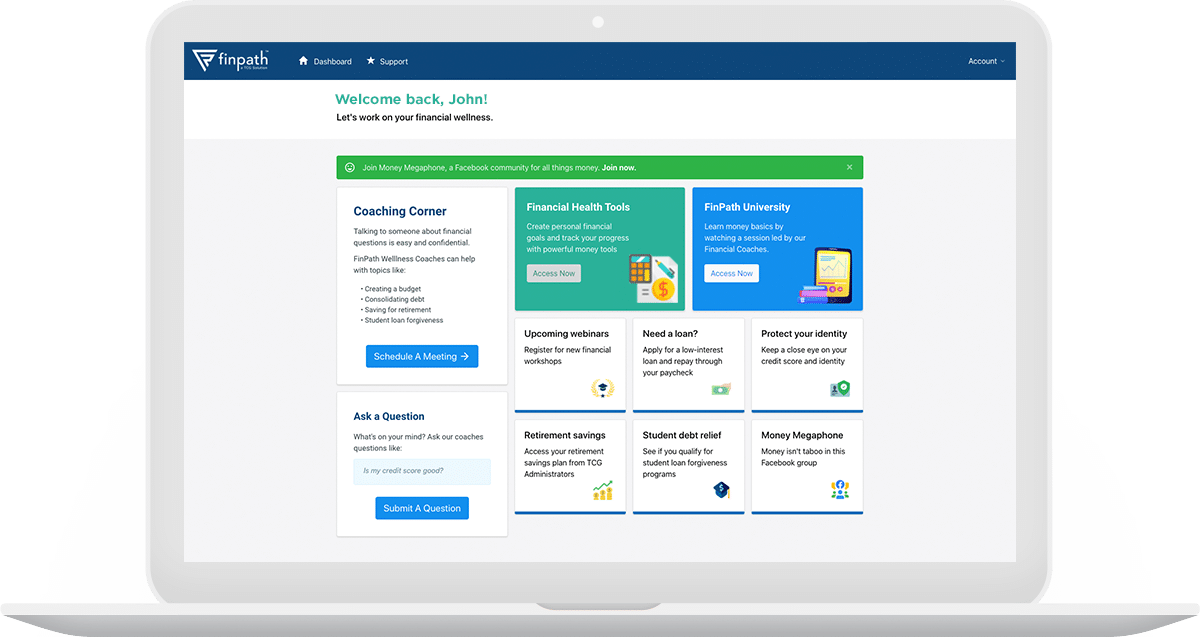

Unlimited 1:1 Coaching

FinPath University Courses

Financial Health Tools

FinPath Program Perks

Coaching

Financial Coaching & Support Network

Truly setting FinPath apart from other programs is to a large network of Wellness Coaches ready to help users navigate their financial journey.

Wellness Coaches do not work on commission and are completely unbiased—they are simply there to help. Sometimes it’s more convenient to speak with a real person who can explain things in a way that a video or learning module can’t.

Anywhere, anytime

Times have changed and so have we. Meet with a coach via phonelive video chat, or in person.

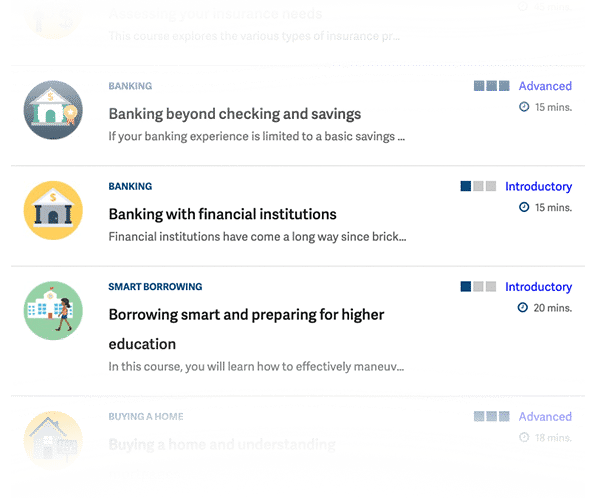

Courses

Step up your money skills with FinPath University

Courses are for everyone, no matter what sort of prior finance knowledge you have. Start with beginner 101 courses and move your way up the ladder with more complex topics. We break down complex financial topics using everyday situations.

Popular courses this year:

- 5 Tips to Maximize Your Paycheck

- Credit is a Powerful Financial Tool – Use it to Your Advantage

- Manage Your Debt or Your Debt Will Manage You

- Student Loan Forgiveness

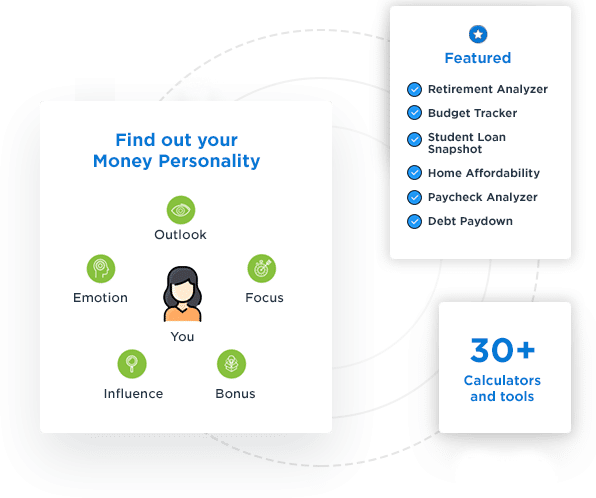

Financial Health Tools

Take action and track your progress with powerful financial wellness tools

With FinPath, you have a complete suite of online tools to help you take control of your finances. FinPath encourages you to perform a series of goals to improve your financial wellbeing—like establishing emergency savings funds, improving credit score, lowering their debt, and more

From retirement, to vacations, to buying a home, we can help you project how much you need to save to accomplish every goal.

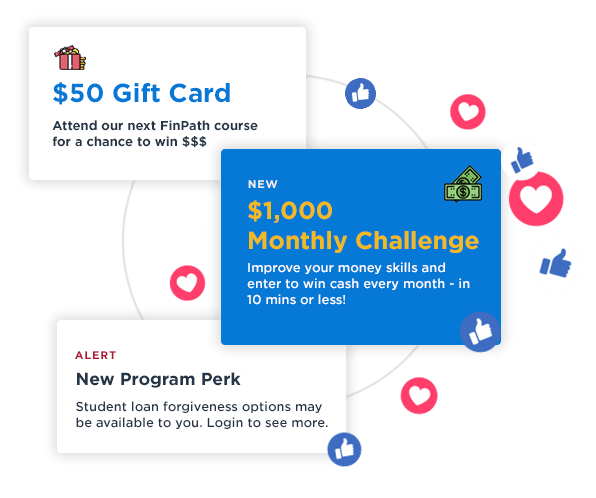

Program Perks

Get rewarded for improving your financial wellbeing

FinPath partners with a list of preferred providers to bring you even more resources and rewards.

Current perks include:

- $1,000 monthly content

- Student loan forgiveness evaluations

- Identity protection and credit monitoring discounts

- Debt consolidation & emergency loans

- Nonprofit referral services

More coming soon!

All that and much more

Loan Consolidation Help

Save and reduce your loan interest by consolidating to a lower APR option.

Facebook Community

Invitation to Money Megaphone, a group for all your money questions answered by Financial Coaches.

Worksheets

Not a fan of all the online tools? We got your back. Access templates ready to fill out manually.

Retirement Analyzer

Are you on track for retirement? We’ll help you evaluate your current roadmap.

College Savings

It’s never too early to start planning for your kids’ college tuition. We’ll help you get started.

So much more

Really. There’s a ton more to explore in FinPath. Plus, we’re always adding more tools for you.

Ready to get started?

1:1 coaching

Financial health tools

and so much more

Onsite events

Turnkey implementation

Payroll integration